DIVESTMENT: NIGERIA’S NATIONAL INTEREST, OIL ASSETS BIDDERS AMIDST ENVIRONMENT, COMMUNITY CONCERNS

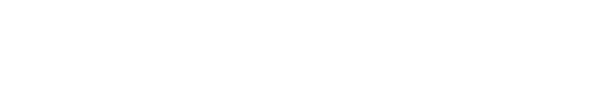

This page is supported by Shell Nigeria. Click here for more information

By Ibrahim Musa

There are strong indications that environmental pollution, conflicts with host communities, community-based petitions, inability or unwillingness to pay judgment debts, decommissioning liabilities as well as lack of financial capacity and technical competence can affect some companies involved in selling and buying Nigeria’s oil assets.

This becomes more obvious as the government has insisted that due process be followed in line with the Divestment Framework, consisting seven cardinal pillars, including technical capacity, financial viability, legal compliance, decommissioning obligations, host community engagement, labor relations, and data repatriation.

Although some companies have made submissions to demonstrate their commitments toward protecting the environment, resolving communal issues, decommissioning as well as financial and technical competence, it was gathered that others have not adequately done so.

Already, the government has cleared two deals involving the divestments of Eni NAOC’s interests in Oil Mining Lease (OML) 60 to Oando and the Equinor– Project Odinmin. The ExxonMobil/Seplat deal, involving the divestment of the entire interest in Mobil Producing Nigeria Unlimited to Seplat Energy is being reviewed. Also, the sale of Shell Petroleum Development Company of Nigeria Limited (SPDC) onshore assets to Renaissance Group has not been cleared.

The group is made up of five Nigerian exploration and production companies (ND Western Limited, Aradel Holdings Plc, FIRST Exploration and Petroleum Development Company Limited, and The Waltersmith Group) plus an international energy group (Petrolin Limited).

But it remains unclear if the sellers have the capacity or are willing to pay pre-deals financial obligations, currently estimated at more than a billion US dollars. Investors stand to reap as the oil assets will add between 300,000 bpd and 350,000 bpd to the nation’s output.

Status of outstanding divestments

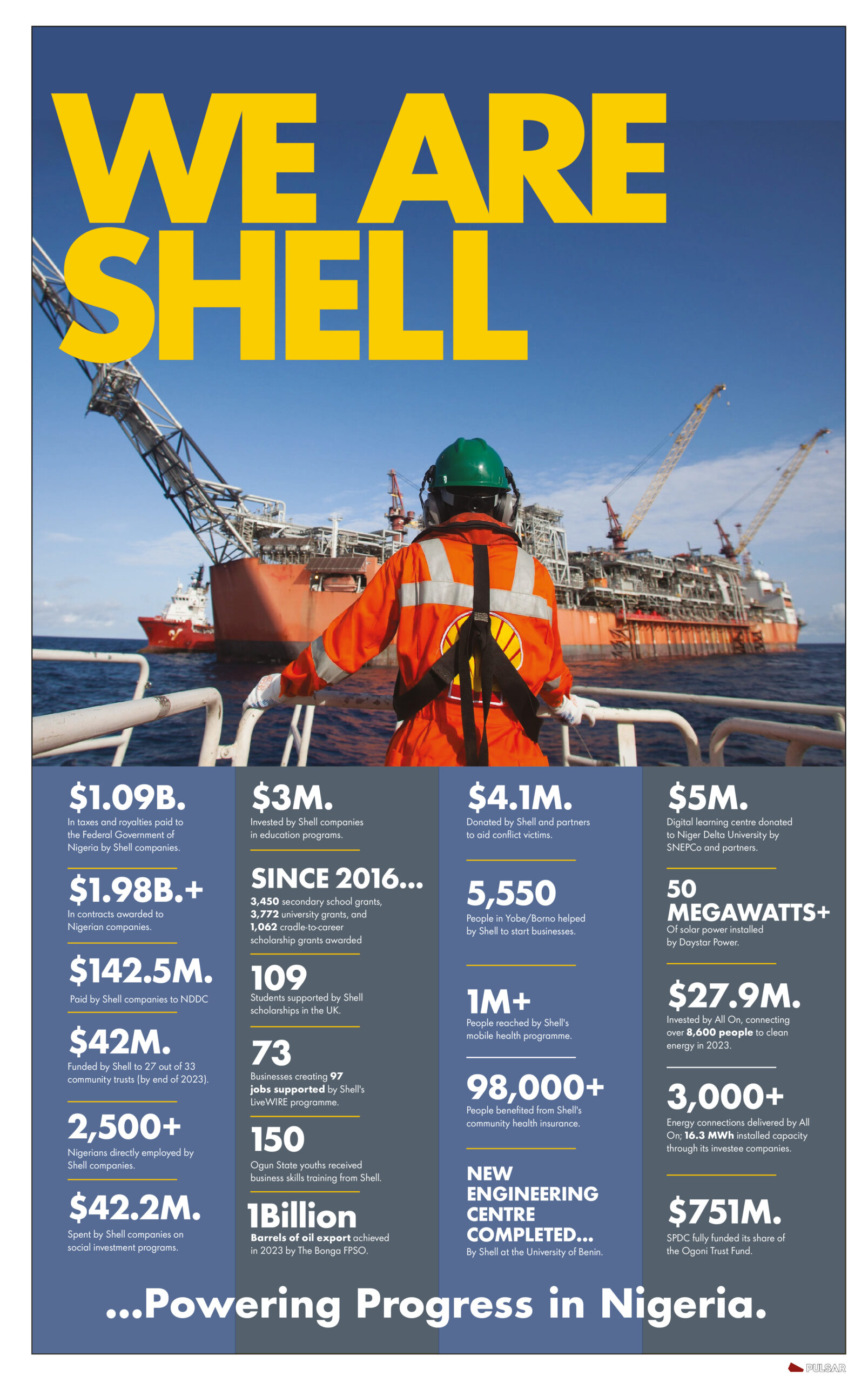

In line with its policy and practices, it was learnt that the Nigerian Upstream Petroleum Regulatory Commission, NUPRC, has concluded plans to provide another update on the status of the various divestments. This is coming barely a few weeks after it presented a similar update on its privatization activities to stakeholders during the NOG Energy Week in Abuja.

However, while some parties are expected to make progress, others with unresolved environmental and community issues, who have even been petitioned by their communities, would not. The government would like to get satisfactory answers or concrete plans for addressing these and other matters, including technical and financial capacities. This means that it would be difficult for companies with such issues to make progress in the race for privatized oil assets, especially as the Commission would not want to be blamed for any consequences.

National interest

As a regulator, the NUPRC is guided by the comprehensive Divestment Framework consisting of seven cardinal pillars. Each aspect is meticulously assessed to safeguard national interest and ensure a seamless transition. The framework was established for the first time in the 68-year history of Nigeria’s exploration and production, in line with the PIA. I think the law should be fulfilled and upheld in Nigeria’s national interest.

Environment, other concerns

The government is worried about the relatively poor state of the environment and the concerns of host communities. This is also in line with available reports. For instance, in its current briefing notes, Shell stated: “Most oil spills in the Niger Delta region continue to be caused by crude oil theft, the sabotage of oil and gas production facilities, and illegal oil refining, including the distribution of illegally refined products.

“In 2023, about 94 per cent of the oil spills of more than 100 kilograms from SPDC-operated facilities were caused by illegal activities of third parties – 139 incidents with a total volume of 1.4 thousand tonnes, compared to 75 incidents in 2022 with a total volume of 0.6 thousand tonnes.

“The increased number of spill incidents in 2023 can directly be attributed to an increase in illegal connections to pipelines, with 119 of the 139 incidents caused by illegal connections. However, through daily inspections from the air and on the ground, we are identifying illegal connections. A total of 675 illegal connections were removed from SPDC pipelines in 2023, compared to 468 in 2022.”

Some concerned organisations, including Spaces for Change, a non-profit organization working to infuse human rights into social and economic governance processes in Nigeria, have expressed displeasure, arguing that under the PIA, oil companies are supposed to submit their decommissioning plans and pay monies into a Decommissioning Fund. The organization and others are demanding that decommissioning should be made a precondition for divestment.

This approach would guide against future problems between the operators of the privatized assets and communities while creating a conducive environment for sustainable operations throughout their lifecycles in a very responsible manner.

Stepping up approvals

Some stakeholders have started mounting pressure on the government. For instance, in its recent statement, the African Energy Chamber, said: “The Nigerian government needs to step up its game regarding approvals for indigenous companies acquiring in-country foreign energy assets.”

While noting the concerns of the organization and others, it should be noted that the NUPRC has come a long way and only needs a little time to conclude the entire process.

Avoiding pitfalls

However, Nigeria should not be rushed into making avoidable mistakes like some countries, especially Brazil, Canada and the United Kingdom at least for a reason. Despite the quest for energy transition, petroleum remains Nigeria’s major source of foreign exchange, with gas as its transition fuel. It should also be emphasized that the NUPRC is not denying the fact that divestment falls within the purview of investors who believe in free entry and exit. It is certainly insisting that it should be conducted in a very credible and transparent manner and best interest of Nigeria, not a few individuals.

. Ibrahim Musa in Energy Analyst